Do I Need to Pay Tax on Crypto? A Simple Guide for Beginners

If you’re new to crypto, one of the most common (and confusing) questions is about taxes. You buy Bitcoin, trade Ethereum, maybe earn some rewards — but do you actually need to pay tax on crypto? The short answer is: in most countries, yes. But the details are not as scary as they sound.

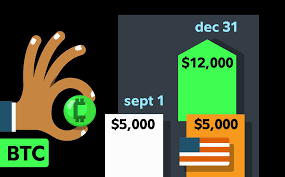

In many places, governments treat cryptocurrency as an asset, similar to stocks or property. This means taxes usually apply when you make a profit, not when you simply buy and hold crypto. If you purchase Bitcoin and keep it in your wallet without selling, there is often no tax due yet. Taxes usually come into play when you sell crypto for a profit, trade one crypto for another, or use crypto to buy goods and services.

Another common taxable situation is earning crypto. If you receive crypto from mining, staking, yield farming, airdrops, or as payment for work, it may be considered income. In that case, the value of the crypto at the time you receive it can be taxable, even if you don’t sell it right away.

However, not every crypto action is taxed the same way. Simply transferring crypto between your own wallets is usually not taxable. Losses may also be useful, because in some countries you can use crypto losses to reduce your tax bill by offsetting gains.

Crypto tax rules vary widely depending on where you live, and regulations are still evolving. That’s why it’s important to keep basic records of your transactions — dates, amounts, and prices — even if you’re just starting out. Many people use crypto tax software or consult a tax professional once their activity grows.

If you’re unsure, the safest approach is to assume that profits and earnings may be taxable and check your local tax authority’s guidance. Understanding crypto taxes early can save you stress later and help you stay compliant while you continue your crypto journey.