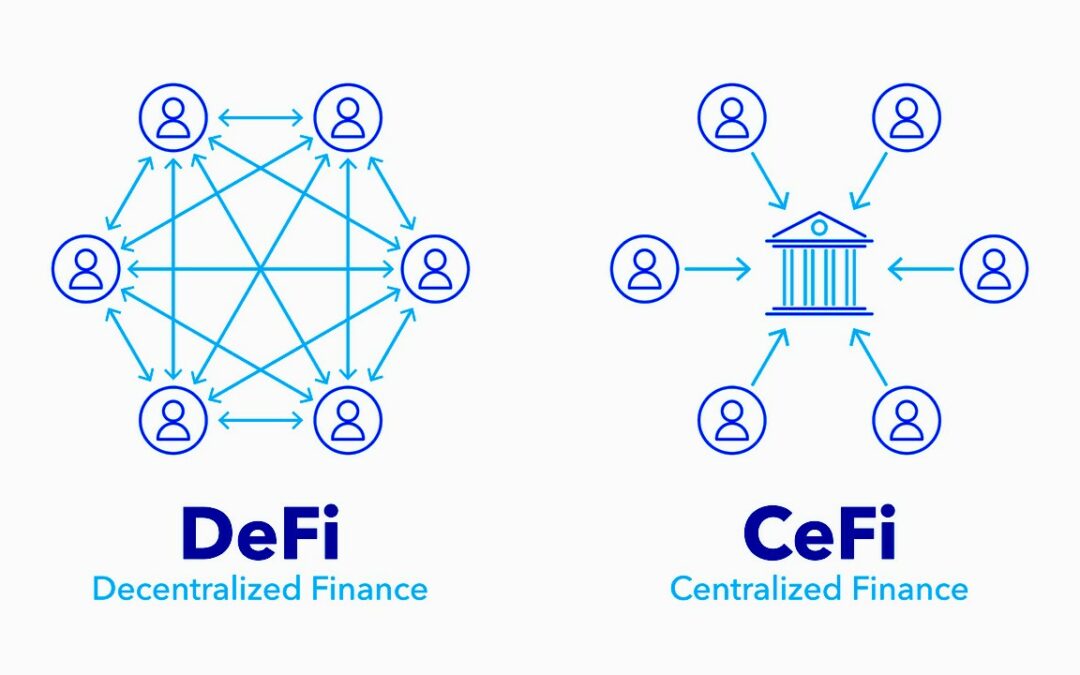

The rise of Decentralized Finance (DeFi) has sparked one of the biggest debates in the financial world: can DeFi actually replace traditional banks, or will it remain a complementary system? While banks have been around for centuries, DeFi offers something radically different—financial services powered by blockchain, without intermediaries.

What Makes DeFi Attractive?

DeFi gives users direct control over their assets. Through smart contracts, people can lend, borrow, trade, or earn interest without needing a middleman. This makes transactions faster, more transparent, and often cheaper than traditional banking. For the millions of unbanked individuals around the globe, DeFi could be the key to financial inclusion.

Where Traditional Banks Still Have the Edge

Despite its innovation, DeFi isn’t perfect. Banks offer consumer protections, regulatory oversight, and established trust systems that DeFi lacks today. Hacks, scams, and smart contract failures are still major risks in the DeFi space. Additionally, not everyone is comfortable managing private keys or navigating crypto wallets.

A Future of Coexistence?

Instead of a complete replacement, the future might be a blend. Traditional banks are already exploring blockchain and stablecoin solutions, while DeFi protocols are working on regulatory compliance and security improvements. The question isn’t just can DeFi replace banks, but rather how much of banking can it reinvent?

Final Thoughts

DeFi has the potential to disrupt finance in a big way, but replacing banks entirely may be unrealistic—at least in the near term. The real transformation could come from a hybrid system where both traditional institutions and decentralized platforms learn from each other, giving people the best of both worlds.