In the ever-evolving world of digital finance, two buzzwords have captured the imagination of both seasoned investors and curious newcomers: DeFi and Crypto. While they may seem similar on the surface, these two concepts have distinct differences that are essential to understand for anyone looking to navigate the exciting, yet sometimes bewildering, landscape of decentralized finance and digital currencies.

What is Crypto?

To start, let’s break down the basics. “Crypto” is short for cryptocurrency. It’s a broad term that encompasses all digital or virtual currencies that use cryptography for security. Bitcoin, perhaps the most famous cryptocurrency, is a prime example. Cryptocurrencies are essentially digital assets that operate on a technology called blockchain. These digital currencies can be used for various purposes, such as online transactions, investments, or as a means of transferring value across borders.

Key characteristics of cryptocurrencies include:

Decentralization

Cryptocurrencies operate on decentralized networks, meaning they are not controlled by a single entity, like a central bank.

Anonymity

Transactions made with cryptocurrencies are generally pseudonymous, offering a degree of privacy.

Security

The use of cryptography ensures the security of transactions and the creation of new units of cryptocurrency.

Volatility

Cryptocurrency prices can be highly volatile, which can present both opportunities and risks for investors.

What is DeFi?

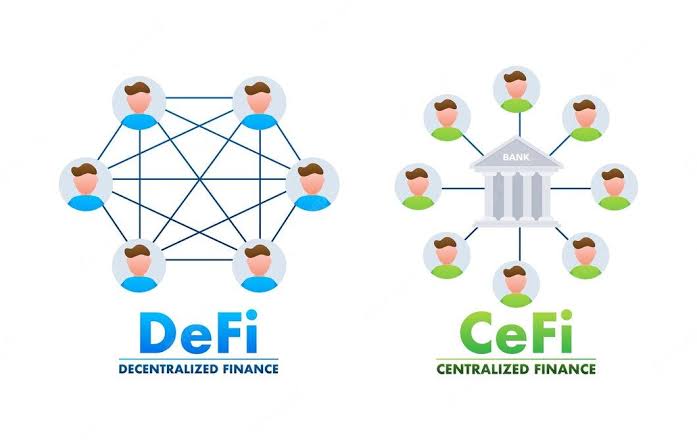

Now, let’s delve into DeFi, which stands for Decentralized Finance. DeFi represents a subset of cryptocurrencies but with a specific focus on creating decentralized financial systems that mimic traditional financial services. Instead of relying on traditional intermediaries like banks or brokers, DeFi applications operate on blockchain technology, allowing users to engage in various financial activities directly with each other.

Key characteristics of DeFi include:

Decentralization

Just like cryptocurrencies, DeFi applications are decentralized, meaning they are not controlled by a single entity. This reduces the need for intermediaries.

Open Source

Most DeFi projects are open-source, allowing anyone to audit the code and participate in the ecosystem.

Financial Services

DeFi offers a wide range of financial services, including lending, borrowing, trading, and earning interest on crypto assets.

Smart Contracts

DeFi relies heavily on smart contracts, self-executing agreements that automatically enforce the terms of an agreement without the need for intermediaries.

Main Differences

Now that we’ve covered the basics of both crypto and DeFi, let’s highlight some of the key differences:

Purpose

Crypto refers to all digital currencies, while DeFi specifically pertains to the development of decentralized financial systems and services.

Use Cases

Cryptocurrencies can serve various purposes, including as a store of value or a medium of exchange. DeFi, on the other hand, focuses on offering financial services like lending, trading, and yield farming.

Intermediaries

DeFi aims to reduce or eliminate the need for intermediaries, while cryptocurrencies can be used within traditional financial systems.

Technology

Both rely on blockchain technology, but DeFi places a greater emphasis on smart contracts and automation.

Conclusion

In summary, while DeFi and cryptocurrencies both operate on blockchain technology and share the principles of decentralization, they serve different purposes within the broader realm of digital finance. Cryptocurrencies are digital assets with various use cases, while DeFi is a specific subset of crypto focused on disrupting and decentralizing traditional financial services. Understanding these differences is crucial for anyone looking to navigate the exciting and rapidly evolving world of digital finance. So, whether you’re considering investing in Bitcoin or exploring DeFi platforms, you’re now better equipped to make informed decisions.