What Makes the Price of Bitcoin Go Up or Down?

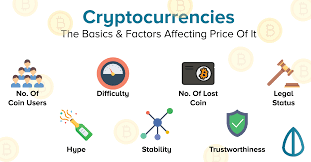

Bitcoin’s price can seem like a rollercoaster ride, with sudden spikes followed by dips that make even seasoned investors watch nervously. Unlike traditional assets, the factors driving Bitcoin’s price can be unique, ranging from market demand to macroeconomic trends. Understanding what makes the price of Bitcoin go up or down can help investors make more informed decisions, especially in this ever-evolving digital currency space.

Supply and Demand

At its core, Bitcoin’s price—like any asset—depends heavily on supply and demand. There’s a limited supply of Bitcoin, with only 21 million coins ever set to exist. As more people become interested in owning Bitcoin, whether for its potential as an investment or its role as “digital gold,” demand increases. If demand is high and the supply is fixed, prices tend to go up. Conversely, if fewer people are buying Bitcoin or if holders are selling, demand drops, and so does the price.

One unique aspect of Bitcoin’s supply is its “halving” events, which occur roughly every four years. During these events, the reward miners receive for validating Bitcoin transactions is cut in half, reducing the rate at which new Bitcoin enters circulation. Historically, Bitcoin halving has led to a rise in price as investors anticipate a tightening supply, though the effect is not always immediate.

Market Sentiment and Speculation

Bitcoin is particularly susceptible to changes in market sentiment. News, social media trends, and comments from influential figures can lead to rapid fluctuations in price. When the news is positive—say, a country adopts Bitcoin as legal tender, or a major company invests in Bitcoin—the price often surges as investors feel confident. On the other hand, negative news, like regulatory crackdowns or cybersecurity breaches, can spark panic selling.

Social media and speculation can sometimes create hype that drives prices up in the short term. This is why Bitcoin has seen sudden rallies where prices skyrocket quickly. However, speculative buying can also lead to sharp corrections if investors decide to cash in profits, causing prices to fall.

Regulatory News and Policies

As Bitcoin has grown in popularity, governments and financial institutions worldwide have taken an interest in its regulation. News about potential regulation—whether it’s a ban in a major economy or the creation of more Bitcoin-friendly laws—can strongly impact Bitcoin’s price. For instance, when China cracked down on cryptocurrency mining in 2021, Bitcoin’s price took a sharp dip. On the flip side, the possibility of a Bitcoin exchange-traded fund (ETF) or regulatory clarity often causes optimism and price increases.

Some investors view regulations as a necessary step for Bitcoin to gain broader acceptance. Others fear that strict regulations could stifle innovation or limit Bitcoin’s appeal as an alternative to traditional financial systems. Either way, regulatory developments are always closely watched in the Bitcoin market.

Macroeconomic Factors

In recent years, Bitcoin has earned the nickname “digital gold” for its potential to act as a hedge against inflation. In times of economic uncertainty, like periods of high inflation or low interest rates, people often look to assets that might hold value over time. When traditional currencies lose purchasing power, Bitcoin can become more attractive as an alternative store of value, causing demand (and price) to increase.

For example, during the COVID-19 pandemic, central banks around the world cut interest rates and increased the money supply to support struggling economies. This led to concerns about inflation, which, in turn, fueled interest in Bitcoin. In contrast, if the economy is stable, interest rates are high, or inflation is under control, investors might favor traditional assets over Bitcoin, causing its price to decrease.

Institutional Adoption

Over the past few years, institutional investors like hedge funds, publicly traded companies, and even some governments have started investing in Bitcoin. When large financial institutions announce their entry into the Bitcoin market, it signals legitimacy and can drive up demand and price. Major companies like MicroStrategy and Tesla have famously purchased large amounts of Bitcoin, causing excitement and boosting prices.

Institutions bring in more capital and stability, but they also impact Bitcoin’s price by their buying or selling actions. When institutional investors buy, it can create a ripple effect, as smaller investors take notice and follow suit. Conversely, if institutions sell large amounts, it could drive the price down.

Mining Costs and Hash Rate

Bitcoin mining is the process by which new coins are created and transactions are validated on the blockchain. This process requires significant computational power, leading to substantial energy costs for miners. When these mining costs are high, miners may need Bitcoin prices to remain high to stay profitable.

The “hash rate,” or the total computational power of all miners in the Bitcoin network, is another factor to consider. A higher hash rate often indicates a more secure network, which can build confidence among investors. Changes in the hash rate, often influenced by regulations or electricity prices, can impact the Bitcoin market.

Global Events and Financial Markets

Bitcoin, once seen as a separate ecosystem, has become more integrated with the global financial landscape. Events that affect global markets, like trade disputes, pandemics, or geopolitical tensions, can influence Bitcoin’s price. When traditional markets are uncertain, some investors view Bitcoin as a safe haven asset. However, as Bitcoin’s correlation with stock markets has grown, broader economic downturns can also lead to sell-offs in Bitcoin, as investors seek liquidity.

Additionally, Bitcoin’s accessibility allows it to be traded globally 24/7, making it responsive to events that occur outside traditional market hours. Economic events that happen over weekends or holidays can lead to price shifts that are amplified by the lack of immediate response from traditional financial systems.

Final Thoughts

Bitcoin’s price movement is complex, with multiple factors working together to create its signature volatility. Supply and demand, market sentiment, regulation, institutional adoption, mining costs, and global events all contribute to Bitcoin’s price trends. For investors, understanding these influences is key to making informed decisions and managing expectations around Bitcoin’s often unpredictable market behavior.

Whether you’re new to Bitcoin or a seasoned investor, keeping an eye on these factors can provide insights into potential price movements. Bitcoin may be volatile, but that very volatility is also what makes it so intriguing and potentially rewarding.