How Improved Interoperability Could Transform the Way We Use Crypto Across Ecosystems

For years, one of blockchain’s biggest challenges has been fragmentation. Bitcoin, Ethereum, Solana, Avalanche, and dozens of other networks all operate in their own isolated ecosystems. While this diversity fuels innovation, it also limits how easily users and developers can move assets or data between chains.

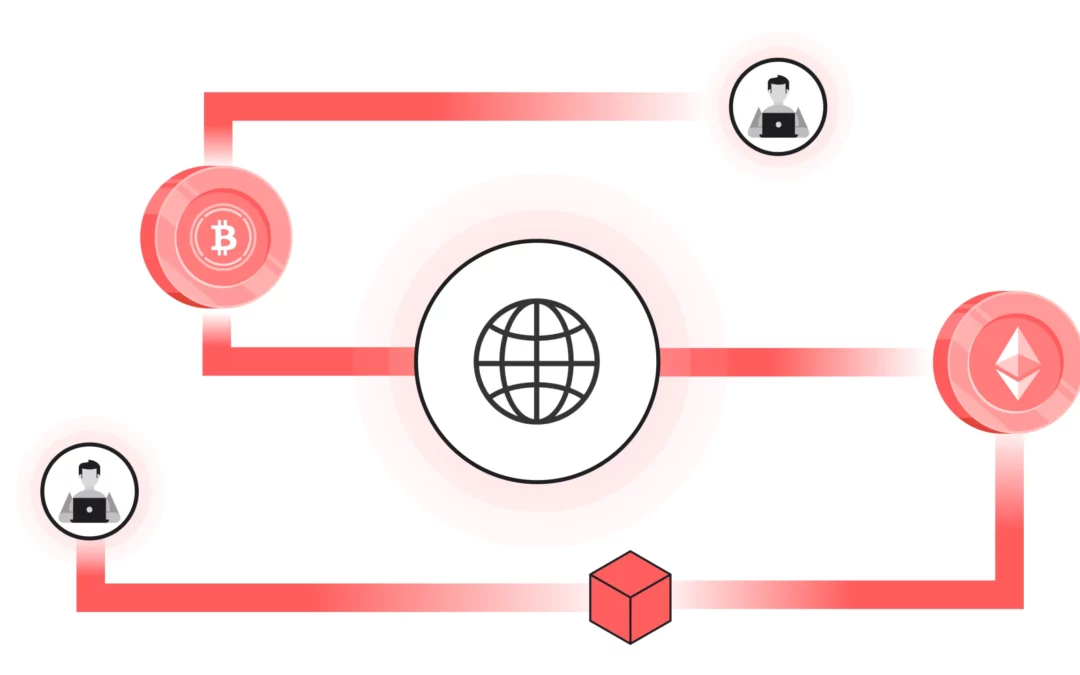

That’s where interoperability — and specifically cross-chain bridges — come in. These technologies aim to connect separate blockchains, allowing them to “talk” to each other and share assets or information without relying on centralized intermediaries.

Why Interoperability Matters

Imagine if the internet only allowed you to visit websites built on the same hosting platform. That’s essentially how the crypto space has worked for years. Each blockchain has its own rules, tokens, and smart contracts — which makes collaboration across ecosystems clunky and inefficient.

Interoperability changes that. By linking different chains, users could:

- Transfer assets seamlessly (e.g., move ETH to a Solana-based DeFi app without centralized exchanges).

- Access more liquidity across decentralized finance (DeFi) markets.

- Use dApps that integrate multiple blockchains behind the scenes.

- Boost network efficiency and reduce congestion by distributing activity.

The Rise of Cross-Chain Bridges

Cross-chain bridges are the current frontrunners in the interoperability race. Platforms like Wormhole, LayerZero, Axelar, and Cosmos’ IBC protocol allow users to transfer tokens or data across chains securely.

However, security remains a challenge. Many early bridge hacks highlighted how vulnerable these systems can be if not designed properly. The next generation of bridges, though, is focusing on zero-knowledge proofs, decentralized validation, and modular security frameworks to reduce these risks.

The Bigger Picture: A Truly Connected Blockchain World

When interoperability reaches maturity, users may not even notice which chain they’re on. Wallets and apps could automatically find the fastest, cheapest route for transactions — whether that involves Ethereum, Polygon, or a new L2 chain.

For developers, this opens the door to composable applications that combine the best features of multiple ecosystems. A lending protocol on one chain could tap liquidity on another, while NFTs minted on Solana could be traded on Ethereum marketplaces without friction.

What It Means for the Future of Crypto

Improved interoperability could fundamentally reshape crypto adoption. It’s the step that turns today’s fragmented networks into a unified digital economy — where value, data, and innovation flow freely.

As bridges get safer and more efficient, the “multi-chain future” everyone talks about may finally feel like a single, user-friendly experience.